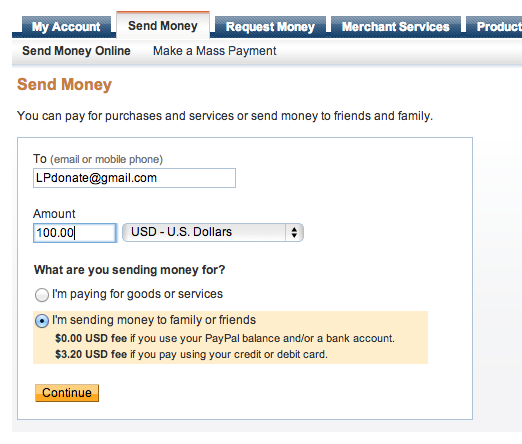

On top of that, you should know that you might also need to pay for currency conversion rates on that as well. Say your payment is USD-based, and then it’ll be a USD 0.30 charge for that. Of course, the fixed fees are different depending on whichever currency you’re based on. But, if your clients are overseas, then you’ll be charged 4.4% + fixed fees. There are only two ways PayPal charges you for receiving money - either by selling to local Hong Kong customers or overseas customers.įor Hong Kong-based customers, you will need to pay an amount of 3.9% + $2.35 HKD per transaction. You can directly transfer the money from the bank account that you link to only by requesting an electronic transfer to it.īut one thing you should take note of is that a markup of 4% will be charged from you for the retail exchange rate when you send a personal/commercial payment that also requires a currency conversion. You don’t even need a PayPal balance in order to send payments to any of your customers/clients. PayPal fees for sending paymentsĮssentially, there’s no fee charged for sending money from your PayPal account for whichever currency your account is holding. Once this is complete, your business account will be ready.

The remaining part is quite simple - verify your email address then link and verify your bank account. Next, it’s the information of your primary authorized user of this account. Step 3: Fill out the basic information of the primary authorized user

#Paypal fees for receiving money calculator code#

This is an electronic device that creates a unique security code that you use to log in to your PayPal account.Here, we streamlined the process into an easy 3-step guide for you to get your PayPal business account running. If you are unsure about which account you need, we recommend reading our article on the differences between PayPal for business and personal. We will not charge you for records requested in connection with your good-faith assertion of an error in your PayPal account. This fee will apply for requests of information relating to why we had reasonable justification to refuse your payment order.

Market Code Table: We may refer to two-letter market codes throughout our fee pages. For a listing of our groupings, please access our Market/Region Grouping Table. Certain markets are grouped together when calculating international transaction rates. International: A transaction occurring when the sender and receiver are registered with or identified by PayPal as residents of different markets. Domestic: A transaction occurring when both the sender and receiver are registered with or identified by PayPal as residents of the same market. To the extent there is any inconsistency between this page, and the CFSGPDS, the latter will prevail. All information regarding fees for Australian customers is available in our Combined Financial Services Guide and Product Disclosure Statement (CFSGPDS). You can also view these changes by clicking ‘Legal’ at the bottom of any web-page and then selecting ‘Policy Updates’. You can find details about changes to our rates and fees and when they will apply on our Policy Updates Page.

#Paypal fees for receiving money calculator pdf#

Download printable PDF Last Updated: 01, January 2023

0 kommentar(er)

0 kommentar(er)